In the competitive world of (re)insurance, having a robust exposure management and pricing platform is essential for accurate risk assessment, portfolio optimization, competitive positioning, and profitable underwriting. When faced with the decision of whether to build a custom solution in-house or adopt an established platform, many organizations are tempted by the apparent control and customization that building offers.

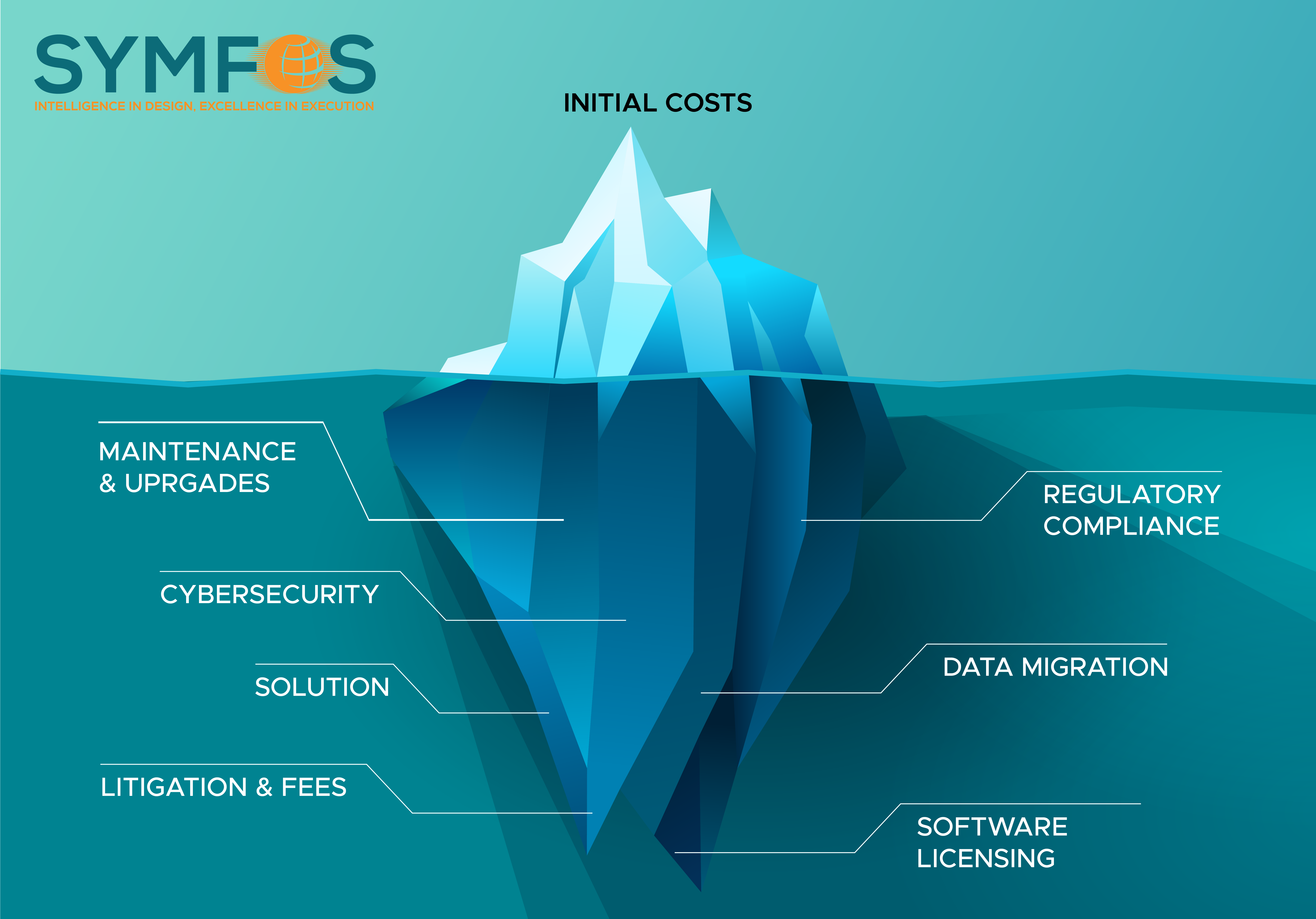

However, the true cost of building your own exposure management and pricing platform extends far beyond the initial development budget. Let’s explore the hidden expenses that can turn what seems like a cost-effective decision into a significant financial burden.

Most organizations focus on the upfront costs when evaluating a buy-versus-build decision:

While these costs are significant-often ranging from hundreds of thousands to millions of pounds-they represent only the beginning of your financial commitment.

Once your exposure management and pricing platform is built, the real work begins. Software doesn’t maintain itself:

Industry estimates suggest that maintenance costs typically consume 15-20% of the original development cost annually.

The technology landscape evolves rapidly. Your custom platform must keep pace:

These upgrades aren’t optional-they’re essential to prevent your platform from becoming obsolete and vulnerable.

Business requirements don’t stand still. Your exposure management and pricing platform must evolve to meet changing needs:

Each enhancement requires analysis, development, testing, and deployment-a cycle that never ends.

Building and maintaining an exposure management and pricing platform requires specialized expertise:

Recruiting and retaining this talent is expensive and challenging. When key developers leave, they take critical institutional knowledge with them, creating additional risk and cost.

Perhaps the most significant hidden cost is what your organization isn’t doing while building and maintaining an exposure management and pricing platform:

Every hour your team spends maintaining a platform is an hour not spent on activities that differentiate your business in the marketplace.

An exposure management and pricing platform doesn’t exist in isolation. It must integrate with:

Building and maintaining these integrations requires ongoing effort, especially as external systems evolve and change their APIs or data formats.

As your business grows, your exposure management and pricing platform must scale accordingly:

What works for 50 users and 10,000 policies may collapse under 500 users and 100,000 policies with complex exposure scenarios.

Exposure management and pricing accuracy is critical in (re)insurance. Every change requires rigorous testing:

Comprehensive testing is time-consuming and requires specialized tools and expertise.

Custom platforms require extensive documentation:

Documentation must be continuously updated as the platform evolves-a task often neglected but critical for long-term sustainability.

Building your own platform doesn’t eliminate vendor dependencies:

These dependencies can create their own switching costs and strategic limitations.

When you add up all these hidden costs over a typical 5-10 year lifespan, the total cost of ownership for a custom-built exposure management and pricing platform can be 3-5 times the initial development cost.

For example, if your initial build costs £1 million, you might realistically expect to spend:

Total 10-year cost: £5-7 million

Established exposure management and pricing platforms like Orchestra offer a compelling alternative:

Predictable Costs

Subscription-based pricing provides budget certainty without unexpected maintenance expenses or major capital outlays.

Continuous Innovation

Benefit from ongoing platform enhancements and new features without additional development costs-innovations funded across the entire customer base.

Proven Reliability

Battle-tested platforms used by industry leaders offer stability and performance that would take years to achieve with a custom build.

Rapid Deployment

Go live in weeks or months rather than years, capturing value immediately rather than waiting through lengthy development cycles.

Industry Expertise

Leverage the domain knowledge of specialists who understand (re)insurance exposure management and pricing challenges and best practices.

Model-Agnostic Flexibility

Work with any model vendor without building and maintaining integrations yourself-true strategic flexibility without vendor lock-in.

Scalability Built-In

Platforms designed to handle enterprise-scale operations from day one, with proven performance under demanding conditions including real-time exposure monitoring.

Building your own exposure management and pricing platform may make sense in rare circumstances:

For most (re)insurance organizations, however, the hidden costs of building make it an expensive distraction from core business objectives.

The decision to build or buy an exposure management and pricing platform shouldn’t be based solely on initial development costs. When you account for the full spectrum of hidden expenses-maintenance, upgrades, talent retention, opportunity costs, and long-term scalability-the true cost of building becomes clear.

Purpose-built platforms like Orchestra offer predictable costs, continuous innovation, and proven reliability, allowing your organization to focus resources on what truly differentiates your business in the marketplace: superior underwriting, portfolio optimization, customer relationships, and strategic growth.

Before embarking on a custom build, ask yourself: Is building an exposure management and pricing platform really your core competency? Or would your organization be better served by partnering with specialists who have already solved these challenges?

The answer may save your organization millions of pounds and years of effort.

Ready to explore a more cost-effective approach to exposure management and pricing technology? Contact Symfos today to discover how Orchestra can deliver enterprise-grade exposure management and pricing capabilities without the hidden costs of building your own platform.

Symfos is a specialist software provider to the (re)insurance industry with special emphasis on the Lloyd’s of London market. To learn more about Hawkeye and the Orchestra platform, visit www.symfos.com or request a demo today.

Bradford has many years of experience in Business Development, as a Senior Sales Director, and Leader with over 20 years P&C Insurance experience and over 10 years selling complex SaaS technology into Enterprise accounts.