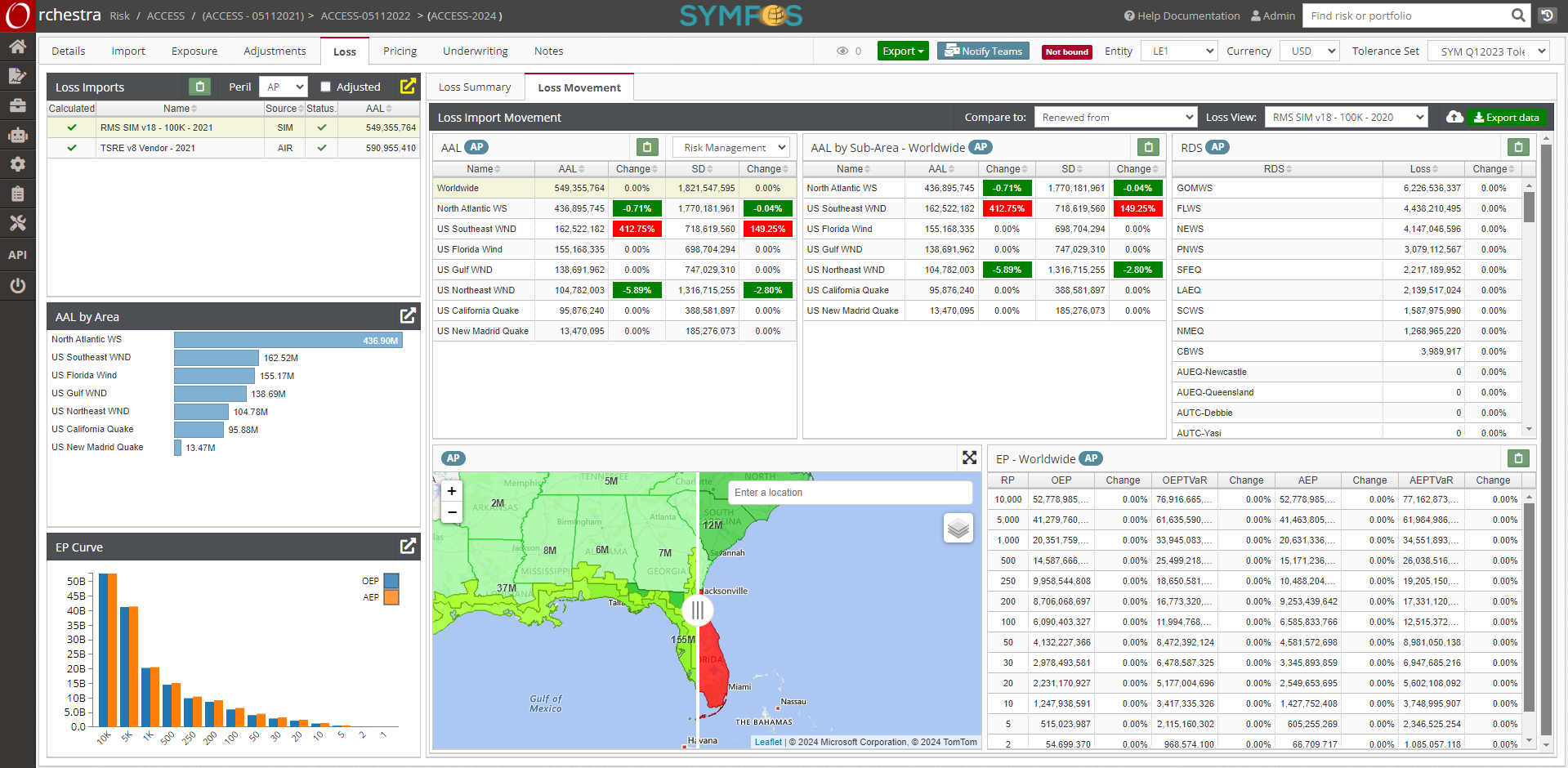

A new era in underwriting and risk management

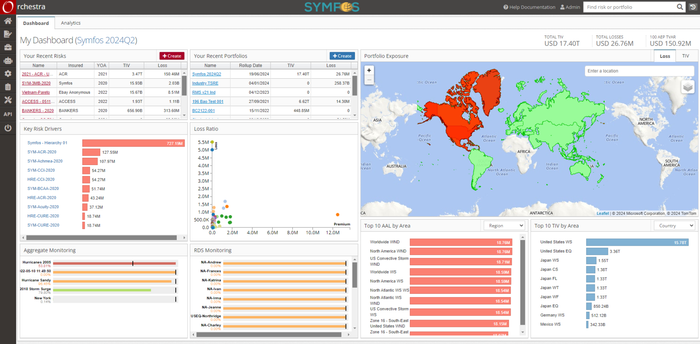

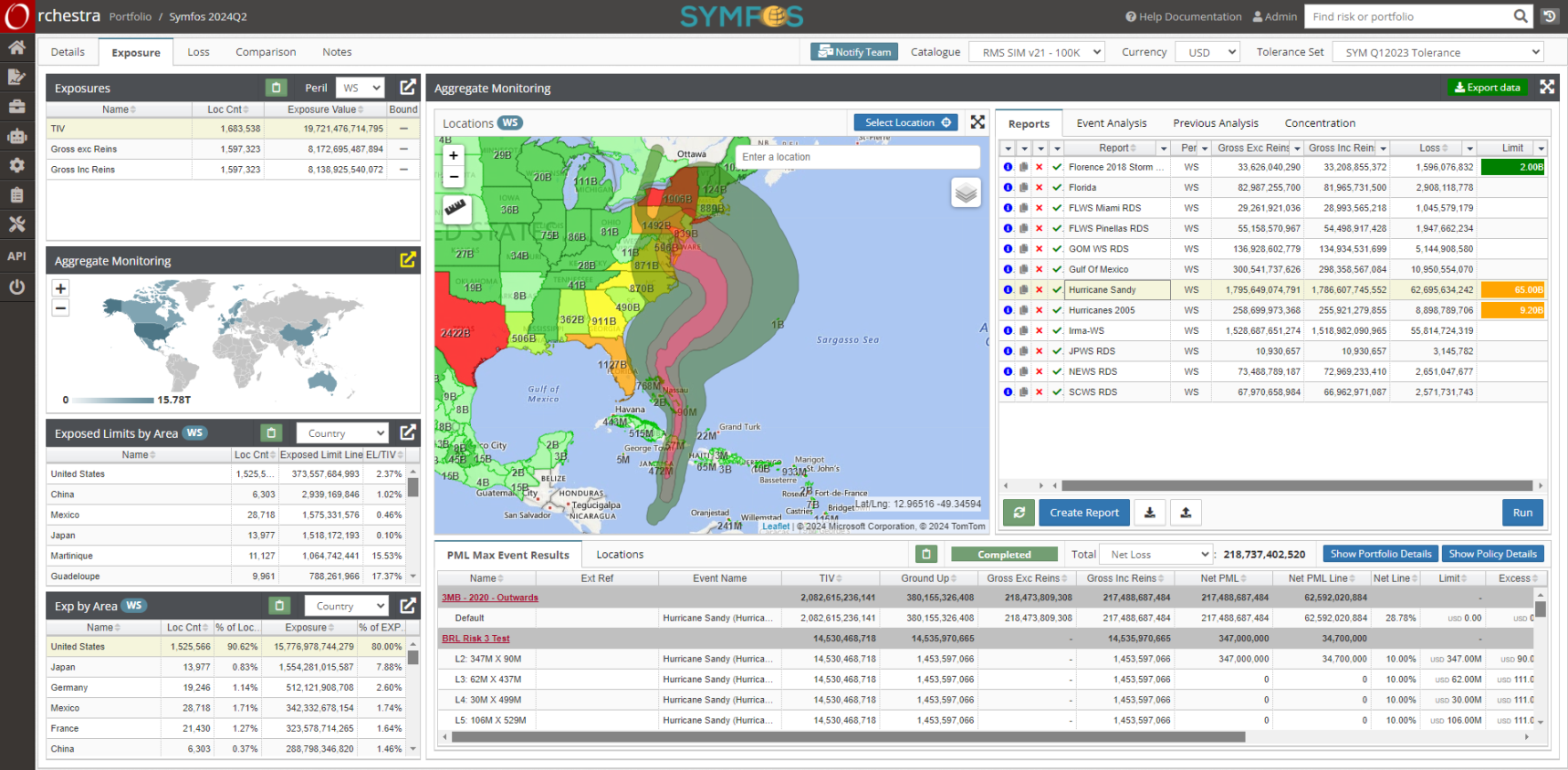

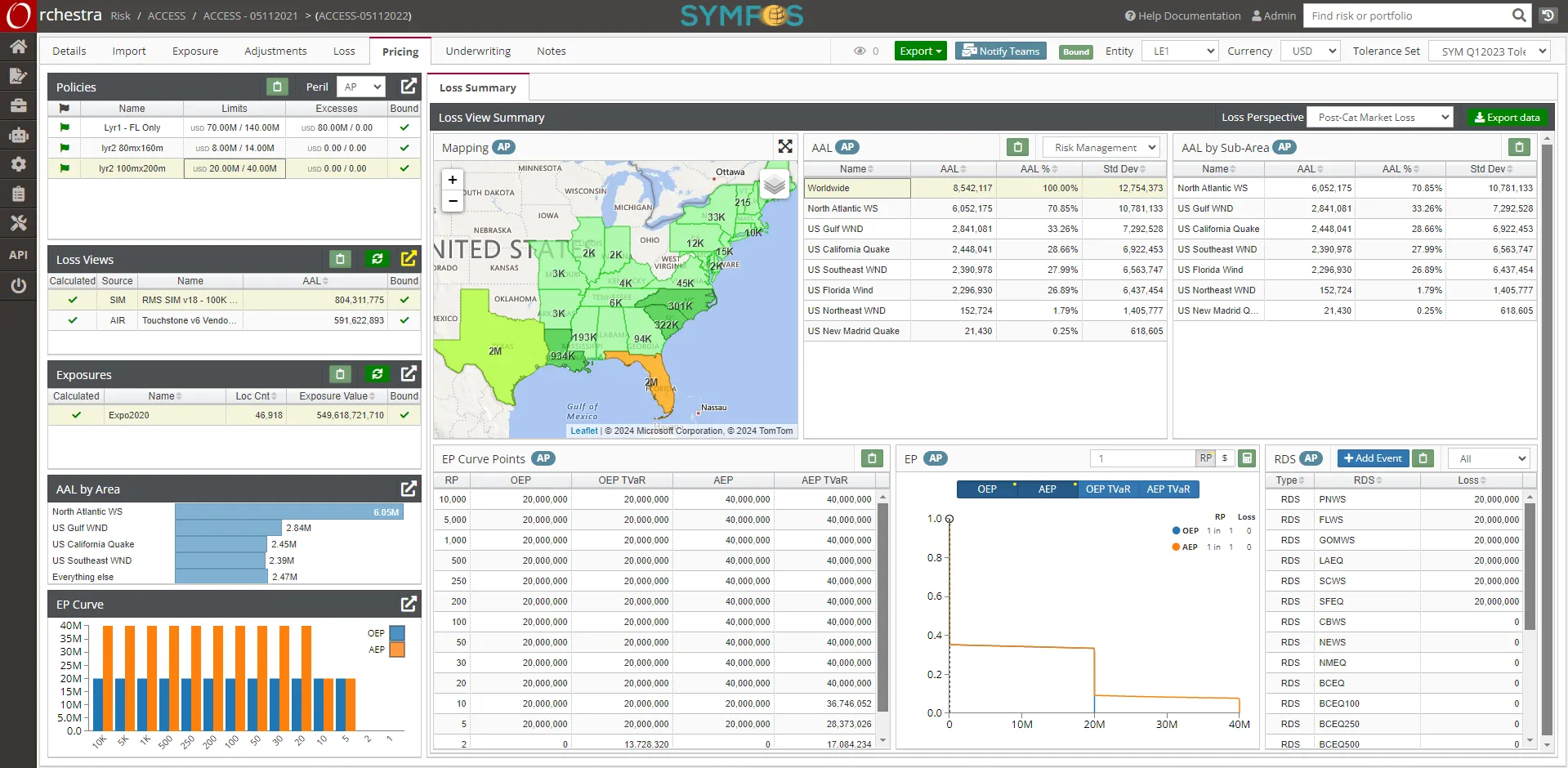

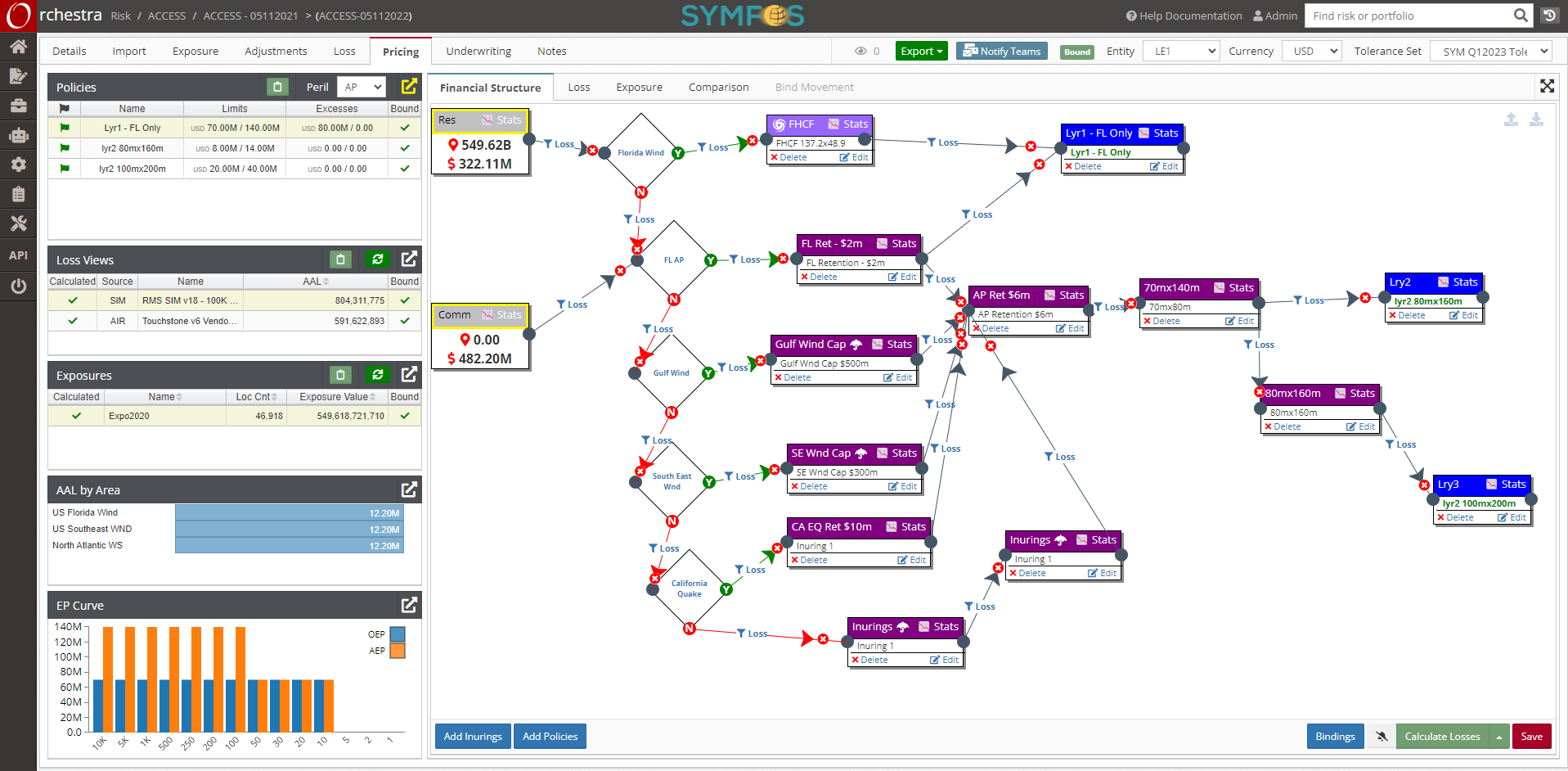

![]() provides a unified and comprehensive view of risk, empowering underwriters,

exposure managers, and modelers with real-time analytics, dynamic pricing,

and model-agnostic capabilities.

provides a unified and comprehensive view of risk, empowering underwriters,

exposure managers, and modelers with real-time analytics, dynamic pricing,

and model-agnostic capabilities.