The strategic decision that’s reshaping how reinsurance companies approach technology investments

In the fast-evolving reinsurance landscape, technology leaders face a critical strategic decision: should they build proprietary solutions in-house or invest in proven, ready-made platforms? This isn’t just a technical choice—it’s a business-critical decision that impacts everything from time-to-market and operational efficiency to long-term scalability and competitive advantage.

Recent industry insights reveal a clear trend: leading reinsurance companies are increasingly choosing the “buy” route, and for compelling reasons that go far beyond simple cost considerations.

To understand why the industry is shifting toward ready-made solutions, let’s examine the common challenges that reinsurance companies face when pursuing in-house development.

Many organizations start with multiple disparate pricing tools that have grown organically over time. These legacy systems often create significant operational bottlenecks, with critical tools accessible only to specific user groups, limiting broader organizational efficiency.

The challenges companies face with their in-house approach are substantial and predictable:

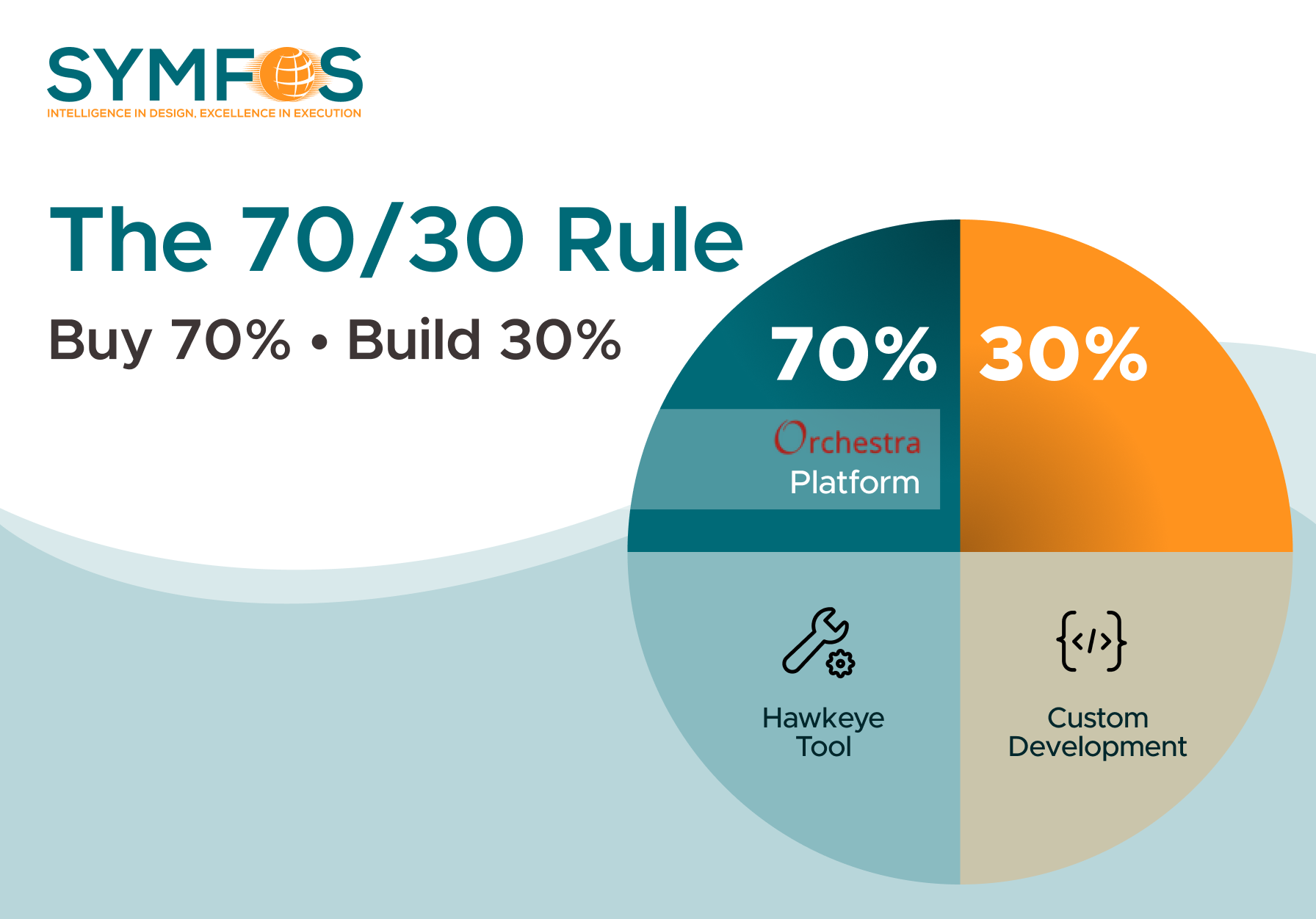

These challenges are driving organizations to evaluate external solutions, with many discovering that modern platforms like Orchestra and Hawkeye can transform their operations—turning complex internal coordination into seamless, unified workflows.

Industry experts increasingly advocate for what’s known as the “buy 70%, build 30%” approach. This philosophy recognizes that while some customization and internal development will always be necessary, the majority of technology infrastructure should leverage proven, market-tested solutions.

This approach offers several strategic advantages:

1. Accelerated Time-to-Value

Ready-made solutions like Orchestra or Hawkeye can be deployed in weeks or months, not years. While organizations often struggle with 6-month delays on basic infrastructure projects, they can implement proven platforms and see immediate productivity gains across their analytics teams.

2. Predictable Investment

Building in-house often involves unpredictable costs and timeline extensions. Infrastructure overruns of costs are common in internal development projects. Ready-made solutions offer transparent, predictable pricing models that align with business planning cycles.

3. Continuous Innovation

When you build in-house, innovation stops the moment you finish development. Platform providers continuously invest in R&D, ensuring your organization benefits from ongoing enhancements without additional development costs.

4. Reduced Technical Risk

Market-proven solutions have been tested across multiple organizations and use cases. This reduces implementation risk and provides confidence in system reliability and performance.

While cost considerations are important, the buy vs build decision extends far beyond immediate financial impact. Consider these strategic factors:

Organizational Focus

Every hour your team spends building and maintaining internal tools is time not spent on core business activities. Organizations that move to proven platforms find their analytics teams can focus on what they do best—analyzing risk and making strategic pricing decisions—rather than managing technology infrastructure.

Scalability and Flexibility

Modern platforms offer agnostic approaches that provide flexibility that legacy custom tools simply can’t match. Ready-made solutions are designed to scale with growing organizations and adapt to changing business requirements.

Talent Acquisition and Retention

Top analytics and underwriting talent wants to work with best-in-class tools. Providing access to industry-leading platforms like Orchestra or Hawkeye can be a significant factor in attracting and retaining key personnel.

Competitive Advantage

While your competitors are still building basic infrastructure, you can be leveraging advanced analytics and insights to make better business decisions faster.

The decision between buying and building isn’t always black and white, but industry evidence strongly favors the “buy” approach for core technology infrastructure. Here’s how to evaluate your options:

Choose “Buy” When:

Choose “Buy” When:

Organizations that have made the transition from build to buy consistently report several key benefits:

The Path Forward

The reinsurance industry’s shift toward ready-made technology solutions reflects a broader recognition that competitive advantage comes from how you use technology, not from building it yourself. Forward-thinking organizations are discovering that platforms like Orchestra and Hawkeye enable them to be more agile, efficient, and focused on their core mission.

The question isn’t whether you can build a solution in-house—it’s whether you should. In most cases, the strategic advantages of proven, market-tested platforms far outweigh the perceived benefits of custom development.

For reinsurance leaders evaluating their technology strategy, the message is clear: focus your internal resources on what makes your organization unique, and leverage best-in-class platforms for everything else. Your team, your timeline, and your bottom line will benefit significantly.

The organizations that recognize this shift early and act decisively will find themselves with a substantial competitive advantage in an increasingly technology-driven market.

Ready to explore how ready-made reinsurance technology solutions can transform your organization? The experts at Symfos can help you evaluate your options and develop a technology strategy that drives real business results. Visit Symfos to learn more about making the right buy vs build decisions for your reinsurance technology needs.

Symfos is a specialist software provider to the (re)insurance industry with special emphasis on the Lloyd’s of London market. To learn more about Hawkeye and the Orchestra platform, visit www.symfos.com or request a demo today.

Bradford has many years of experience in Business Development, as a Senior Sales Director, and Leader with over 20 years P&C Insurance experience and over 10 years selling complex SaaS technology into Enterprise accounts.